Topic: Introduction to Book Keeping

CONTENT: 1. Meaning, Concepts of Book keeping

2. Importance and Parties interested in Book keeping

Meaning of Book Keeping:

Book-keeping may be defined as the art of recording business transactions in a systematic

manner so that the books of account will reveal at any time the financial position of the

business to the owner and other stakeholders in the business

Importance and Parties Interested in Book-Keeping

[b]Importance of Book Keeping:[/b]

Every business organization keeps daily records of their financial transactions. Therefore,

the importance of bookkeeping becomes necessary for the following reasons:

(i) It is for easy reference of business financial records.

(ii) It shows an accurate standing position of business in relation to its customers i.e. what is owed and what is owed by the firm

(iii) It reveals profits and losses position to the company through trading profit and loss account.

(iv) It provides information to members of the public who are interested in the business through the balance sheet.

(v) Auditors use the books to issue their audit reports.

(vi) The records kept help in management decision-making.

(vii) The records project the image of the business to the public.

ESSENTIAL QUALITIES OF BOOK-KEEPING OR A BOOK-KEEPER

• He or she must be honest

• False entries should not be made into the book

• He or she must be hardworking, punctual to work and must show interest in the job

• He or she must be able to keep records

• He or she must have a legible handwriting

• He or she must have retentive memory

COMMON BOOK-KEEPING PRACTICES

• A single line ruled beneath an amount by the bookkeeper is an indication that a remainder or a total will follow

• The use of ruler when drawing single or double rulings make for neat accounting work.

• The Naira and Kobo signs are usually written on top and not in a ruled column.

• Two zeros are written in the kobo column when an amount to be written does not have the aspect. The kobo column must not be left blank. It should be filled with two zeros

• When a bookkeeper applies a double ruling across an amount column, this indicates that the work above has been completed and accurate.

BOOK-KEEPING ETHICS

• Accountability

• Probity

• Transparency

• Objectivity

• Fairness

https://www.slideshare.net/effersonrami ... ing-system

Evaluation:

1. State five importance of Book-keeping.

2. Explain the parties interested in Book-keeping.

Essay:

1. Explain the term book-keeping

2. State three importance of book-keeping.

LESSON 24

Topic: Source Documents and Journals

PREVIEW: 1.Meaning and Importance of Source Document

2. Types of Source Document

Meaning of Source Document

Source Document may be defined as original documents on which monetary transactions are

recorded, which provide necessary information for the preparation of books of original entry.

Transactions are the major feature of any business. The business transactions take place when goods and services are transferred from one person to another. There are two types of transaction namely cash and credit transaction. Cash transaction means that money is paid immediately the transaction occurs. Credit transaction means that payment for what is bought or sold is made at a later date.

Importance of Source Document:

1. To originate data for accounting records.

2. They act as working evidence or as a proof of occurrence of such transactions.

3. They enable various books of accounts to be opened.

4. They serve as a source of information.

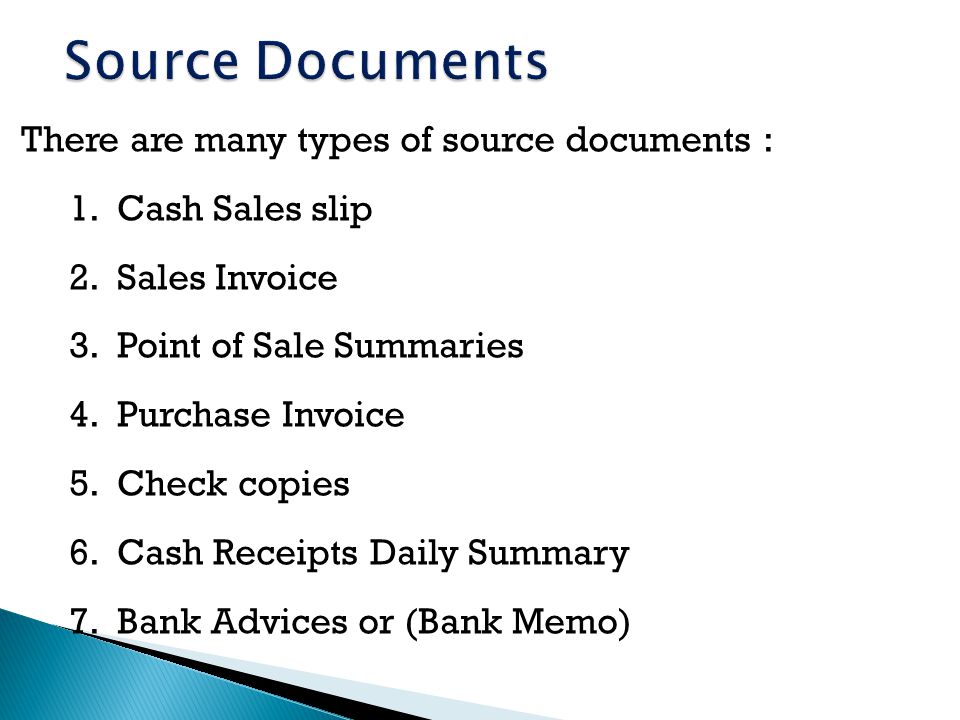

Types of Source Document

Types of Source Documents:

The major types of Source documents are:

(a) Invoice: This document is usually issued by the seller to the buyer immediately goods are dispatch or services rendered on credit. It shows description of goods bought or sold, quantity, unit price, total cost.

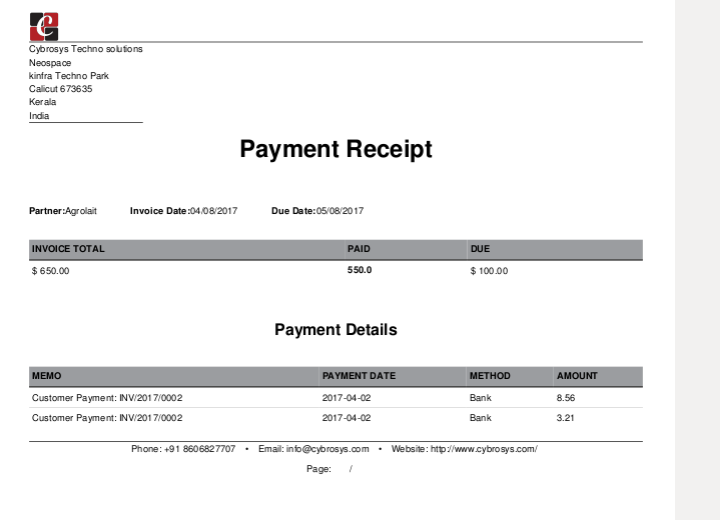

(b) Receipt: This document serves as an evidence of payment for goods bought or sold and services rendered. Receipts are given or received whenever cash is paid or collected for goods bought or sold or services rendered. It shows the following particulars:

(i) The reason for payment

(ii) The amount of money received

(iii) The person who made the payment and to whom the payment was made to.

(iv) The date of payment

(c) Cheque: A cheque is defined as a written order or instruction made upon a bank to pay a specific sum of money to a named person at a specific date. A cheque is a source document used as a means of receipts and payments instead of the physical cash.

Parties to a cheque

There are three parties to a cheque namely – the drawer, the drawee and the payee

(i) The drawer is the owner of the account who issues out or draws the cheque.

(ii) The drawee is the bank to whom instruction is given to pay.

(iii) The payee is the person to whom the money will be paid.

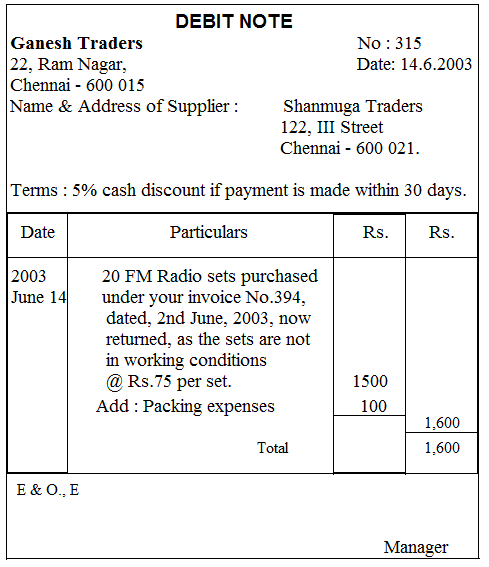

(d) Debit Note: This is sent by the seller to the buyer when there is an undercharge in the original invoice. A debit note can also be sent when there is an omission or return of goods.

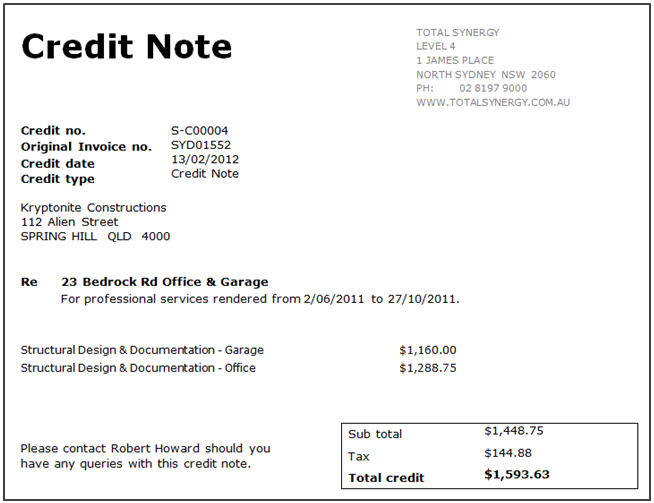

(e) Credit Note: This is normally printed in red to distinguish it from an invoice. It is used when an invoice is overcharged, that is when the buyer is wrongly overcharged.

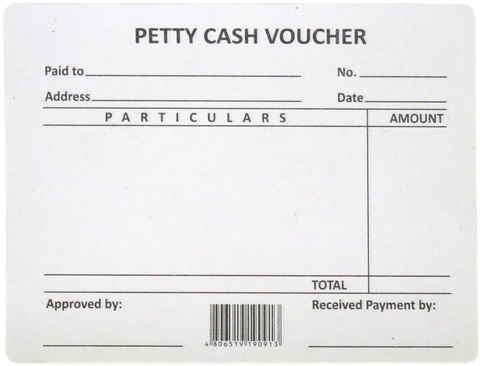

(f) Petty Cash Voucher: This is a written authorization to pay small amounts in cash. Usually the Petty cashier fills out the voucher and ensures that the person requesting the cash signs it. The petty cashier then disburses the money and files the voucher in the petty cash container.

g. Cash registered tape: A cash registered tape is a machine for quick and accurate recording. This helps when recording volume of transaction. The machine automatically prints receipt on the tape for the customers each time a sale is made.

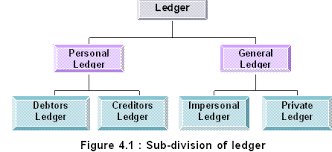

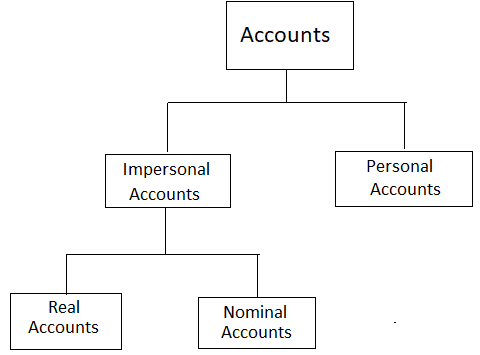

BOOK OF ORIGINAL ENTRY

Book of original entry are books in which data from source documents are first

assembled and classified before being recorded in the principal book of account called the ledger. They include the following:

• Sales day book or sales journal

• Purchases day book or purchase journal

• Return inwards book and

• Return outwards book

• The Journal

https://www.slideshare.net/mandalina/ad ... -documents

EVALUATION:

1. Source document provides information for (a) preparation of books of original entry

(b) debiting account (c) directors and managers

2. The two types of transaction are ------------ and ------------

(a) cash and credit (b) payment and credit (c) credit and debit

3. A source document used as a means of receipt and payments instead of cash is

(a) Invoice (b) cheque (c) Debit note

4. A debit note is used when there is -------- (a)overcharged (b) undercharged

(c) credit sales

5. An evidence for payment is ------------- (a) invoice (b) credit note (c) receipt

Essay:

1. Explain the types of transaction

2. State three importance of source document.

3. Explain the term invoice

4. Differentiate between Credit note and Debit note

LESSON 25

SOURCE DOCUMENT AND JOURNALS

Journal is a document which contains the daily records of business transactions. Each

record in a journal is called an entry. The journal is called a book of original entry

because the entries the entries are transferred to a second book.

Types of Journal

We have two major division of Journals: General Journal and Special Journal

a. General Journal: this is a book that records all transactions (both sales and purchases). It is used when no special journal exists.

b. Special Journal: these are separate journals that are kept for credit transactions concerning sales and purchases. Types of Special Journals are listed below:

a. Purchases Journal

b. Sales Journal

c. Return Inward Journal

d. Return Outward Journal

Let’s take each of them one after the other.

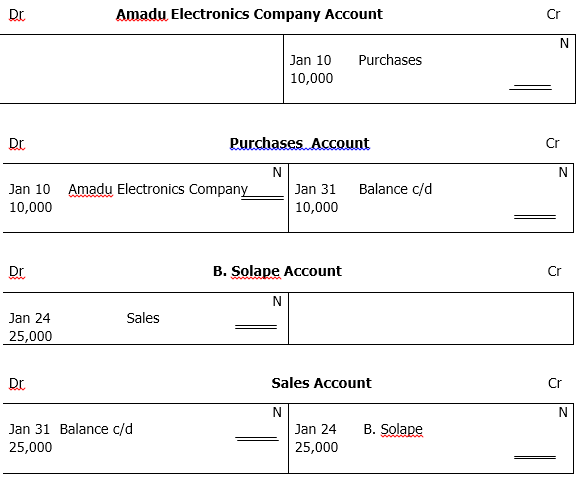

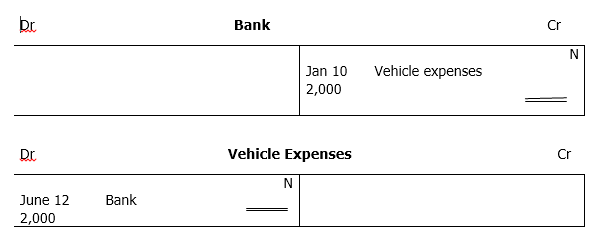

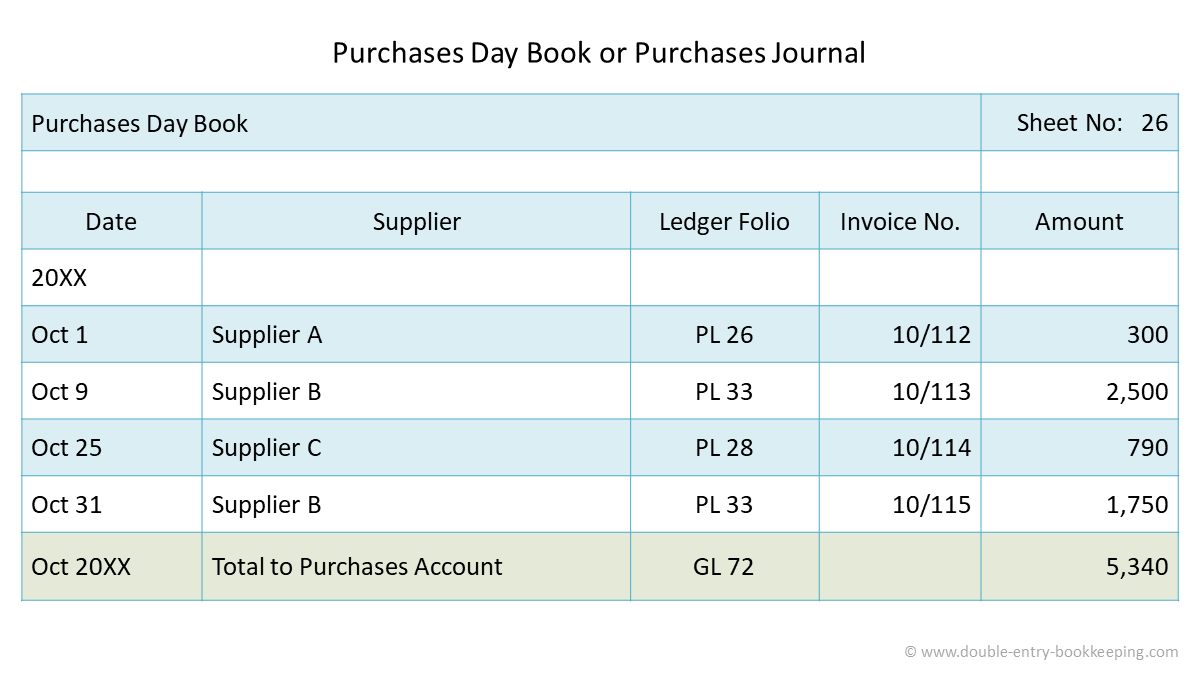

Purchase Day Book or Purchases Journal

Purchase Day Book: This is also known as Purchase Journal. It is used to record all daily particulars of goods bought for resale on credit while the cash purchase is entered into the credit side of the cashbook. It is maintained exclusively for credit purchases of goods meant for resale. The particulars of the goods in the purchase journal include the date that of purchase, the seller’s name, the gross amount, the amount of trade discount if given (subtracted from gross amount), the net amount owed to each seller and the total amount of purchases for a given period. Entries are made in the purchase journal from the purchase invoices issued by the sellers.

PREPARATION OF PURCHASE JOURNAL

Debit purchase account with the total amount of purchases for the period. Credit individual seller (creditor) account with the net amount.

Example

Enter these transactions in the purchase journal of Oke & sons for the month of June 2000, and post this to the ledger,

June 15 Ekpe & Co.: Invoice No. 102

- 15 Dozen Eraser at 250k a dozen

- 30 Rulers at 50k each

- 40 Writing pad at 10k each

- 200 Envelopes at 15k per 25

- Invoice subject to 10% trade discount

- 10 Reams of foolscap at N350 per ream

- 6 Dozen Exercise books at N12 a dozen

- 21 B. Allegro, invoice No. ACP 134 N6,500

- Subject to 20% trade discount

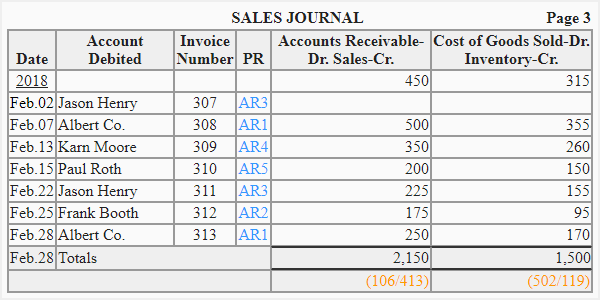

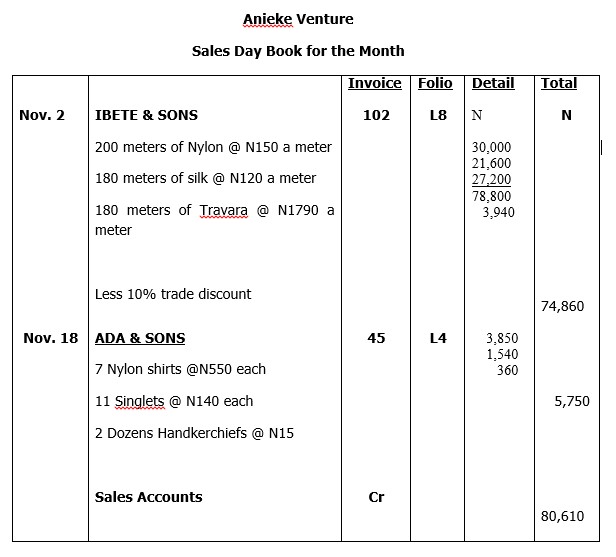

SALES JOURNAL: This is one of the books of original entry. It is used to record daily sales of goods on credits. The recording of transactions into sales journals is the same as purchase journal except in posting to the ledger. In the ledger, debtors (customers) personal accounts are debited and sales accounts credited in the general ledger with the total amount of credits sales for the period.

Example

Aneke venture is a dealer is cloth materials. Enter the transaction below in his sales day book.

November 2, 2000 Sold to Ibete $ Sons and issued invoice No. 163

200 Meters of Nylon material at N150 a meter

180 Meters of Silk material at N120 a meter

160 Meters of Travara material at N170 a meter

Invoice is subject to 5% trade discount

November 18, 2000 Sold to Ada & Sons invoice No. 46

7 Nylon shirts at N550 each

11 Singlets at N140 each

2 Dozens handkerchiefs at N115 each

https://drive.google.com/file/d/1ZCY8L2 ... sp=sharing

EVALUATION

1. What do you understand by the term Purchase day book and Sales day book?

2. What is the purpose of each journal?

LESSON 26

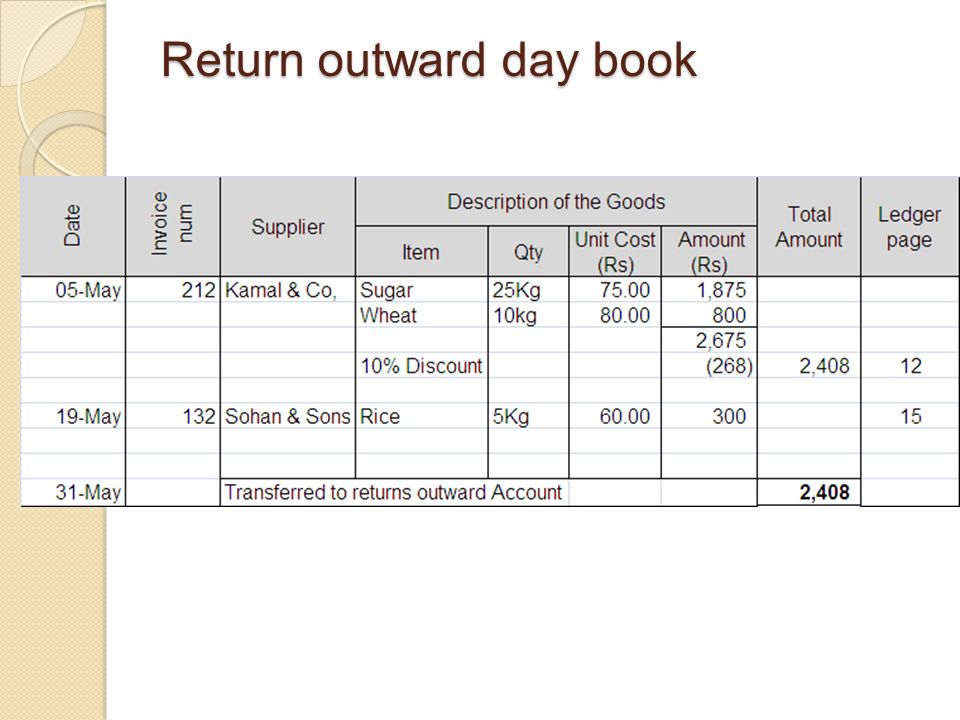

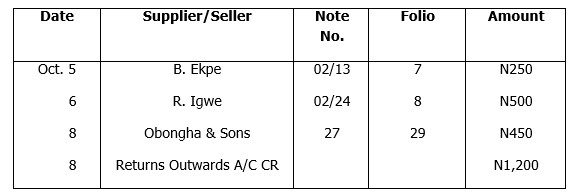

Returns Outward Day Book and Returns Inward Day Book:

Returns Outward Day Book:

This day book is also called Returns outward Journal. It is used for used for recording all goods returned to the sellers and allowances granted by them. Entries are made from the credits notes received from the seller. The total amount of the returns and allowances for a period are credited to the returns outwards account in one figure in the ledger while individual items are debited to the personal accounts sellers in the purchase ledger.

Example:

The following returns were made to sellers on the dates shown. Record them in the returns outwards journal.

Oct. 5 Returned 1 carbon of biscuit at N250 to B. Ekpe, Credit Note No. 02/13

Oct. 6 Returned to R. Igwe Note No. 02/44 N500

Oct. 8 Received a note from Obongha & Sons on goods returned, Note No.27 N450

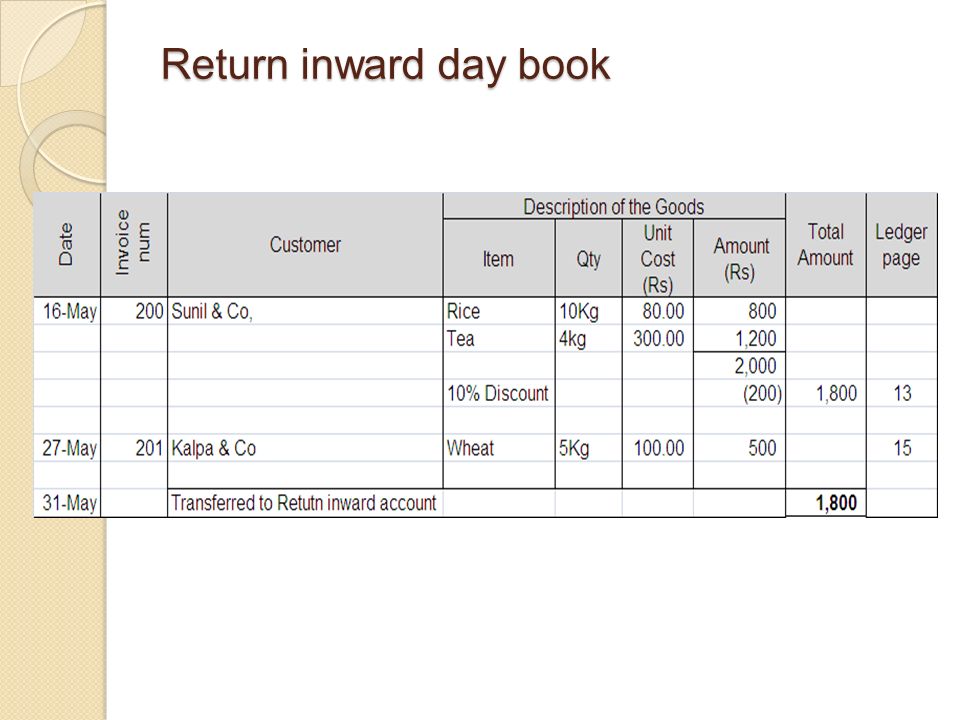

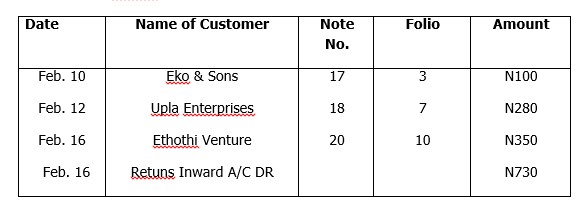

Returns Inward Day Book:

This day book is also called Returns inward Journal. It is used for recording the particulars of all goods returned by customers and the allowance granted to them. The source document for returns inwards journals is the credit note prepared by the seller who is accepting the goods returned.

Example

The following returns were made by Ibete & Co customer on the date specified. Record the transactions into the returns inwards journal.

Feb.10 Eko & Sons, Note No. 17 N100

Feb.12 Upla Enterprises Note No. 18 N280

Feb.16 Ethothi Ventures Note No. 20 N350

https://www.slideshare.net/ramusakha/ba ... accounting

EVALUATION

1. Explain the term Return Outward Day Book

2. What is the purpose of Returns Inward Journal?

READING ASSIGNMENT

Business Studies for Junior Secondary School Book 2 produced by Cross River State Government Chapter 12 pages 62-67

ASSIGNMENT

1. From the following particulars, prepare purchases day book of Eteng & Co.

Jan. 5 Bought goods from Arikpo and Sons

3 Cartons of Biscuit at N450 a carton

2 cartons of Jumbo matches at N350 a carton

The invoice is subject to 5% discount

Jan. 8 Received invoice No. 11 from Abuo Enterprises.

4 dozens of 40 leaves exercise books at N600 a dozen

100 erasers at 5 for N2

20 rulers at N4 each

2. Credit sales were made to the under mentioned customers. Record the transaction in the sales journals.

April 5 Okoro Enterprises, invoice No. 02/8 N1,020

April 7 Otan & Co., invoice No. 02/12 N2,500

April 9 Ogbodin, A.A. invoice No. 02/16 N1,350

April 10 Agbo & Sons, invoice No. 02/20 N3,150

April 15 Peterson invoice No. 02/21 N1,235

3. A Credit note was received from Onete Ukam by E. Ina. Below is the credit note No. 102:

1 Carton of biscuit at N350 N350

25 Empty cases returned at N15 each N375

N725

You are required to prepare returns outward journal

4. Record the following transactions into the returns inward journal

June 6 O. Etim, Note No. 41 275

June 8 A. O. Aduquo, Note No. 43 330

June 9 Onda Enterprises, Note No. 44 250

June 11 Owal & Sons, Note No. 46 315

Evaluation:

1. Define the term cheque.

2. State three types of source document

https://www.slideshare.net/srinivasmeth ... ccountancy

Reading Assignment:

Business Studies for Junior Secondary School Book 1 produced by Cross River State Government, Chapter 8 & 9 pages 47-54