LESSON 9

FORMS OF BUSINESS ORGANIZATION

CONTENT: 1. Types of Business Organisations

2. Advantages and Disadvantages of each of the Business Organisation

Meaning of Sole Trade

Meaning: Sole Trade is a business owned by one person. The size of the business may be large or small but it is important to note that it is owned by one man. Examples are restaurants supermarkets, Filing Station, Schools etc. The owner of the business is called a sole trader or a sole proprietor. Another name for sole trade is sole proprietorship.

Advantages of Sole Trade:

Advantages of Sole Trade:

1. It is easy to start.

2. The sole proprietor has a close contact with his customers and attends to them personally.

3. He takes all decisions affecting his business alone.

Disadvantages of Sole Trade:

Disadvantages of Sole Trade:

1. The provision of capital and ability is limited.

2. The business ends when a sole trader dies.

3. He suffers and bears risks alone

4. If business fails, he may have to sell his personal property to pay the debt.

Evaluation:

1. State at least three advantages of Sole Trade

2. Identify at least three disadvantages of Sole Trade.

Reading Assignment:

Business Studies for Junior Secondary School Book 1 produced by Cross River State Chapter 7 pages 38-39

LESSON 10

Partnership

CONTENT: 1. Meaning of Partnership

2. Advantages and Disadvantage of Partnership

Meaning of Partnership

Meaning of Partnership: A Partnership is a business owned and managed by two or more persons who become partners by written agreement. The partnership act of 1890 and the companies Act of 1958 state that the maximum number of people who can form a Partnership is restricted to 20 persons while the minimum should be 2 persons. These partners share the profit or losses and the responsibilities of their business.

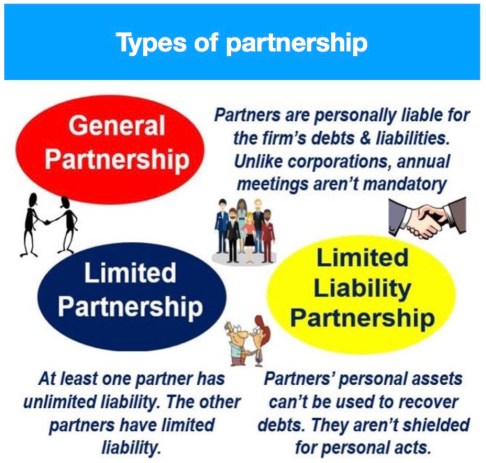

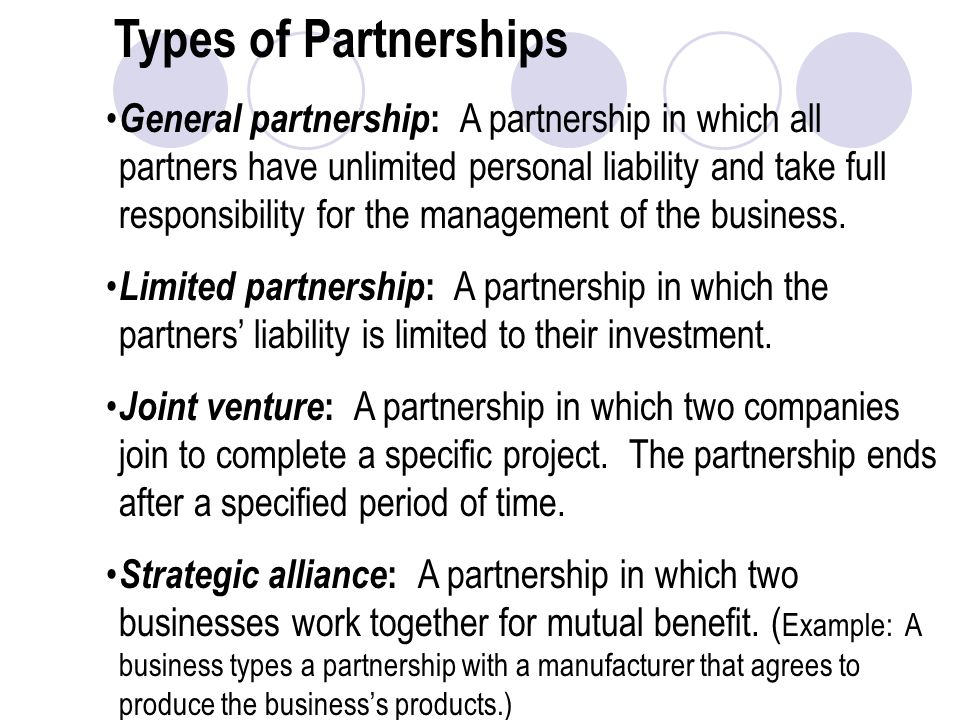

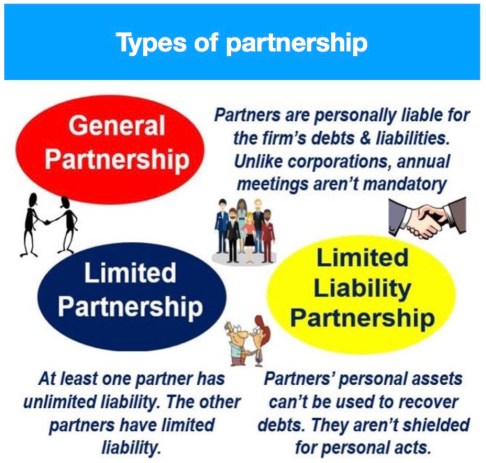

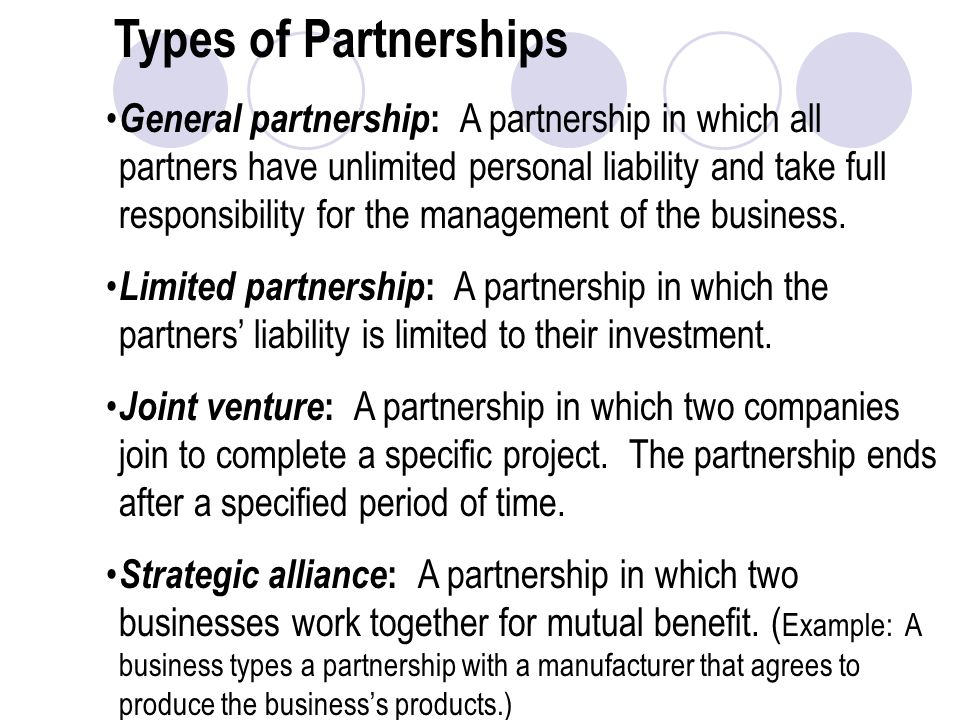

Types of Partnership:

Types of Partnership: There are various types of partnerships as stated below:

(a)

Ordinary Partnership: This is a partnership in which all members are held liable for the debts of the business. Partnership may be dissolved if one partner dies.

(b)

Limited Partnership: This is a partnership with limited liability in that members will not be asked to contribute more money that the one used to start the business in case the business fails. For Partnership to become limited, it must be registered with the Registrar of Companies otherwise it will be treated as ordinary partnership.

(c)

Active and Sleeping Partners: Partners who take part in running the business are active partners while those who do not take part in the running of the business are sleeping partners.

(d)

Quasi or Nominal Partners: A quasi partner is not really a partner but may conduct himself in such a way as to make himself liable for the debts of the firm, even though he does not take part in sharing the profit of the business.

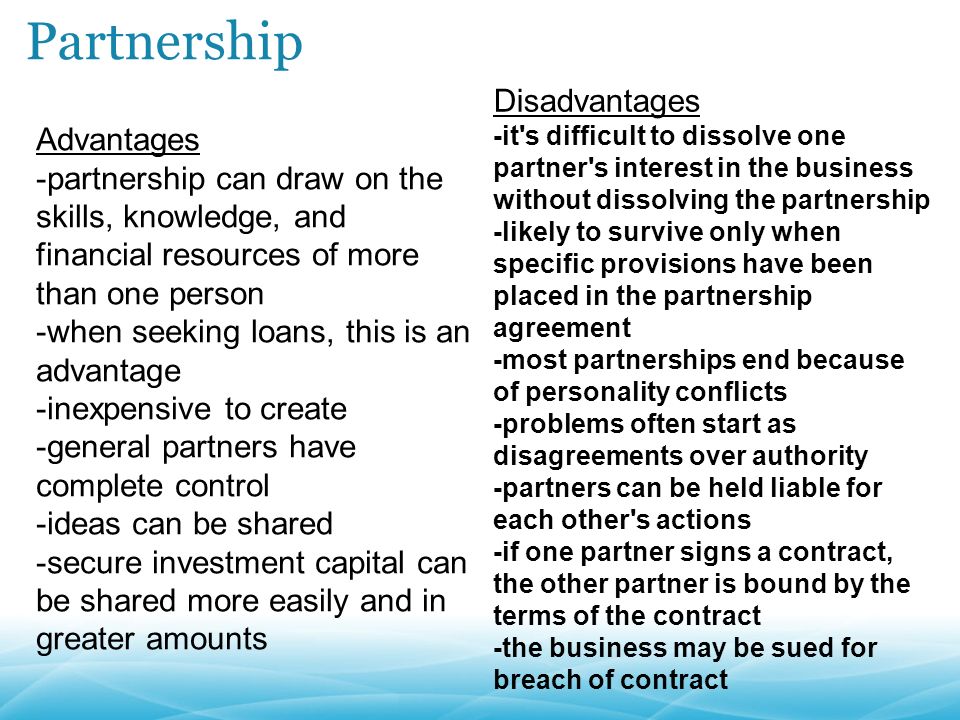

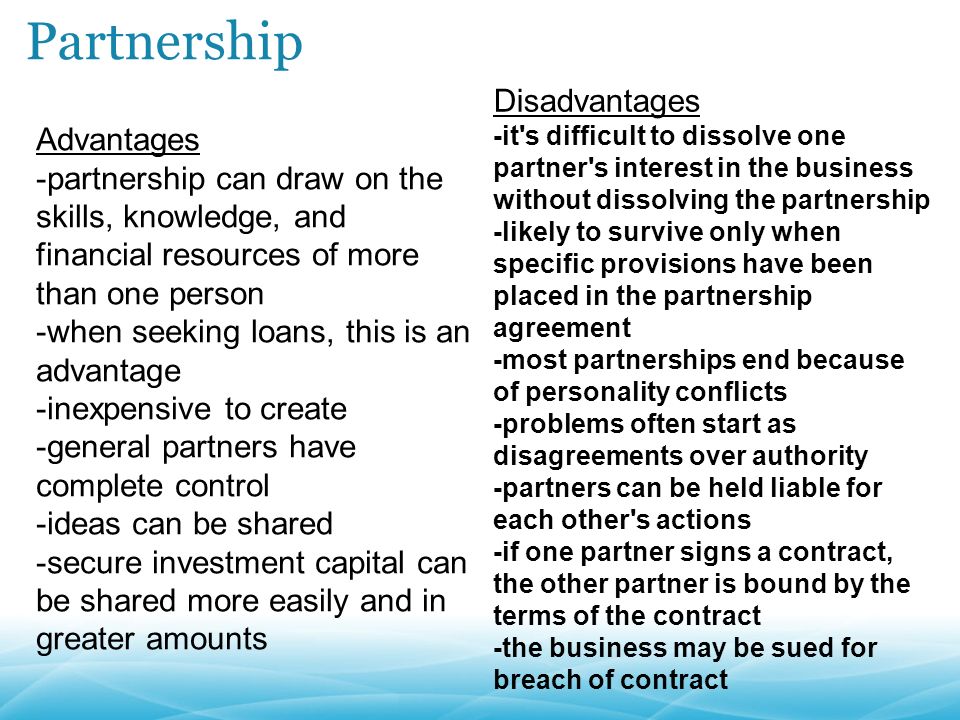

Advantages of Partnership:

Advantages of Partnership:

(i) It has more capital than sole trading

ii Partners have different ability and talents therefore, each partner specializes in an aspect of business which he is best suited.

(iii) Partners meet to discuss matters relating to the firm

Disadvantages of Partnership:

Disadvantages of Partnership:

(i0 Partners have unlimited liability for debts in case of business failure.

(ii) If one partner takes a wrong decision, it affects other partners.

(iii) Disagreement among partners causes confusion in the business.

(iv) Partnership comes to an end with the death or resignation of a partner.

Evaluation

Objectives:

1. Another name for Sole Trade is -------- (a) Sole Proprietorship (b) Partnership (c) Restaurant

2. Sole Trade is the business of ---------- (a) two people (b) two men (c) one person

3. The simplest and most common form of business organization is (a) Partnership (b) Sole trade (c) Filing station

4. One of the disadvantages of Sole trade is ---------- (a) He takes all decisions affecting his business (b) He bears and suffers risk alone (c) he enjoys his profits alone

5. One of the source of capital to a sole trader is (a) easy to start (b) personal savings (c) members’ contribution

6. The minimum number of Partners in Partnership is (a) 5 (b) 2 (c) 4

7. The type of partnership in which all the members are held liable for debts of the business is ------ (a) quasi partnership (b) Ordinary partnership (c) limited partnership

8. One of the sources of capital for partnership is ------ (a) contribution of capital by members (b) personal saving (c) limited partners

9. The disadvantage of partnership is ---------- (a) Wrong decision of one partners affect others (b) Losses are shared among partners (c) it has more capital than sole trading

10. All are advantages of Partnership except (a) Death of one partner may end the business (b) Responsibilities are shared among partners (c) It has more capital than sole trading.

Essay

1. What is Sole Proprietorship?

2. Mention all the sources of capital of sole trade.

3. What is Partnership?

4. Outline two advantages and two disadvantages of Partnership

5. Define Partnership.

6. Explain the following types of partnership: (a) ordinary Partnership (b) Quasi Partnership

Reading Assignment:

Business Studies for Junior Secondary School Book 1 produced by Cross River State Government Chapter 7 pages 39-41

https://drive.google.com/file/d/1EDOUlp ... sp=sharing

LESSON 11

Cooperative Societies

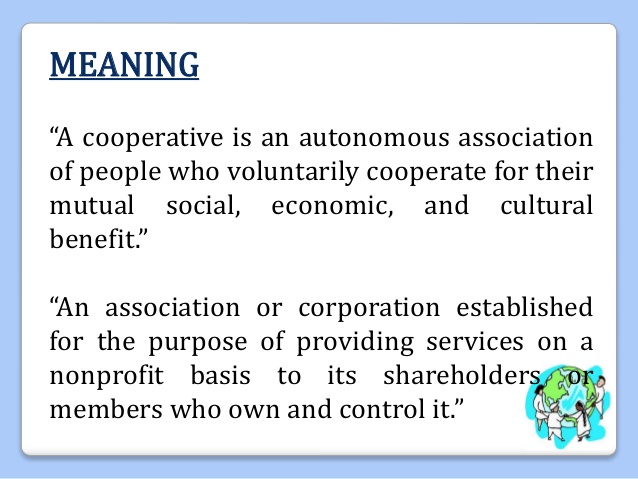

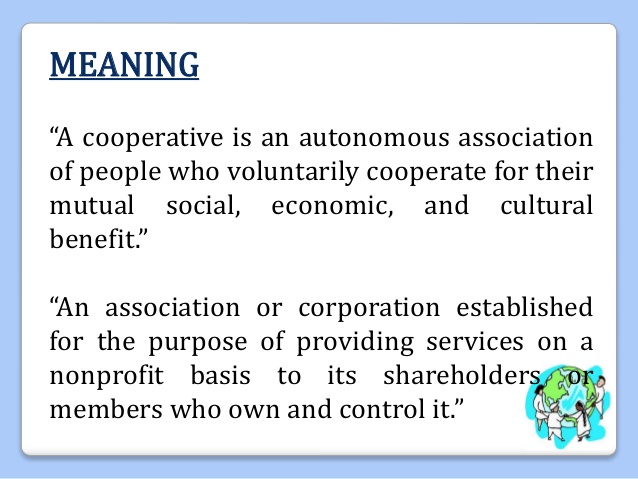

Meaning of Cooperative Societies

A cooperative Society exists when groups of workers, individuals, organizations, farmers or

Communities pull their resources together towards a common goal. The main purpose of the cooperative society is to:

(i) Sell goods and services to members at a cheap rate.

(ii) to do business together for profit purpose and share the profits among the members.

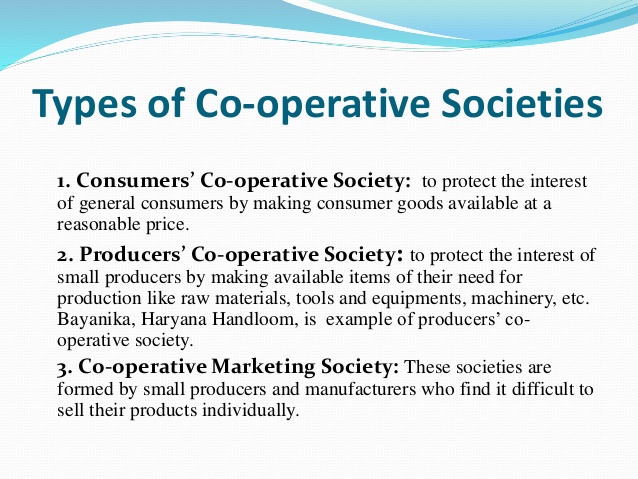

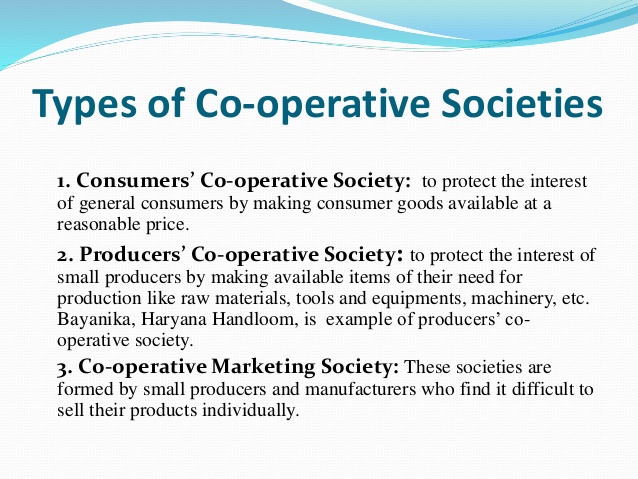

Types of Cooperative Society:

Types of Cooperative Society:

The common types of cooperative societies are:

(a) Producers Cooperative

(b) Consumers Cooperative

(a) Producers Cooperative:

(a) Producers Cooperative:

Producers form a common association in order to sell their products in a uniform price instead of selling individually, e.g. producers of yam, garri, cocoa etc may form a cooperative society for the selling of their products.

(b) Consumers Cooperative:

In consumers’ cooperative, the members are consumers who contribute funds and buy goods in large quantities from the producers and sell in retail prices to members at a reduced and cheaper rate.

Advantages of Cooperative Society:

1. Members have equal rights and votes.

2. Prices are lower as they buy in bulk.

3. Benefits of repayment of capital to any member who withdraws.

Disadvantages of Cooperative Society:

1. Election of committee members may not lead to efficient business.

2. Calculation of dividends to members is always a problem.

3. Non-members may be reluctant to engage in marketing activities with the cooperative.

https://www.slideshare.net/miemslou/adv ... operatives

Evaluation:

1. What do you understand by the term Cooperative Society?

2. Mention three advantages of Cooperative society.

Reading Assignment:

Business Studies for Junior Secondary School Book 1 produced by Cross River State Chapter 7 pages 42-43.

Assignment:

Objectives:

1. What is the maximum of number of persons that can be admitted into the society? (a) No maximum (b) 20 (c) 30

2. Cooperative Society is managed by (a) Board of Directors (b) Committee of management (c) shareholders

3. The common types of cooperative societies are

(a) Sole Proprietorship and partnership (b) Young and old cooperative (c) Producer and Consumer Cooperative

4. In cooperative Society every members have equal rights and votes. True/False

5. The main purpose of cooperative society is to (a)buy goods for everybody (b) provide essentials services at cheaper rate (c) sell goods and services to members at a cheap rate

LESSON 12

Limited Liability Company (Public Limited Liability Company)

Limited Liability Company:

A Limited Liability Company is a company in which the responsibility or liability of members for debts of the company is limited to the capital they have contributed or agreed to contribute. The private property of members are excluded, and all that members lose if the company fails is the money they have contributed. It is formed and registered under the law known as the Company Act. When a company is formed and registered with the Registrar of Companies, it is said to be incorporated.

There are two types of Limited Liability Company namely, Private and Public Companies.

Public Limited Liability Company:

A Public Limited Liability Company is a business unit that carries on business to make profit

for its owners. Examples are Nigerian bottling company Ltd., Total Nigeria Limited, First Bank of

Nigeria Plc. It is owned by Shareholders and managed and control by Board of management.

https://www.slideshare.net/ry_moore/lim ... o-29828149

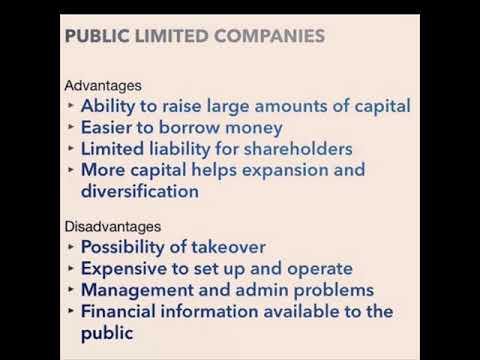

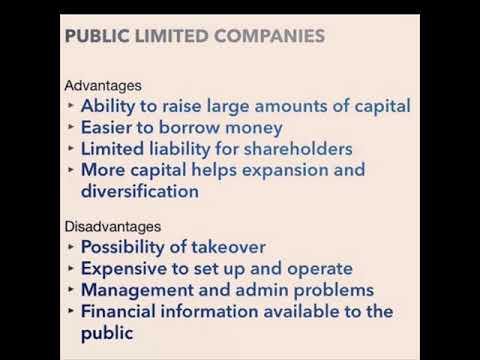

Advantages of Public Limited Liability Company

1. It can raise money from the public through issuing of shares and debentures. This

enhances the company expansion.

2. It is a legal entity because it can sue and can be sued.

3. The company’s properties are different from that of its owners.

4. It enjoys continuity because it has perpetual life. The company can only be wounded voluntarily or on the order of a law court.

5. Share holders cannot lose more than the value of their shares. This is because the company enjoys limited liability.

Disadvantages of Public Limited Liability Company:

Disadvantages of Public Limited Liability Company:

1. Shareholders have little say in the running of the company

2. It does not enjoy privacy. It annual account must be published in the Newspaper for the public to see.

3. It suffers from double taxation. The net profit of the company is taxed and the dividends of the shareholders are also taxed.

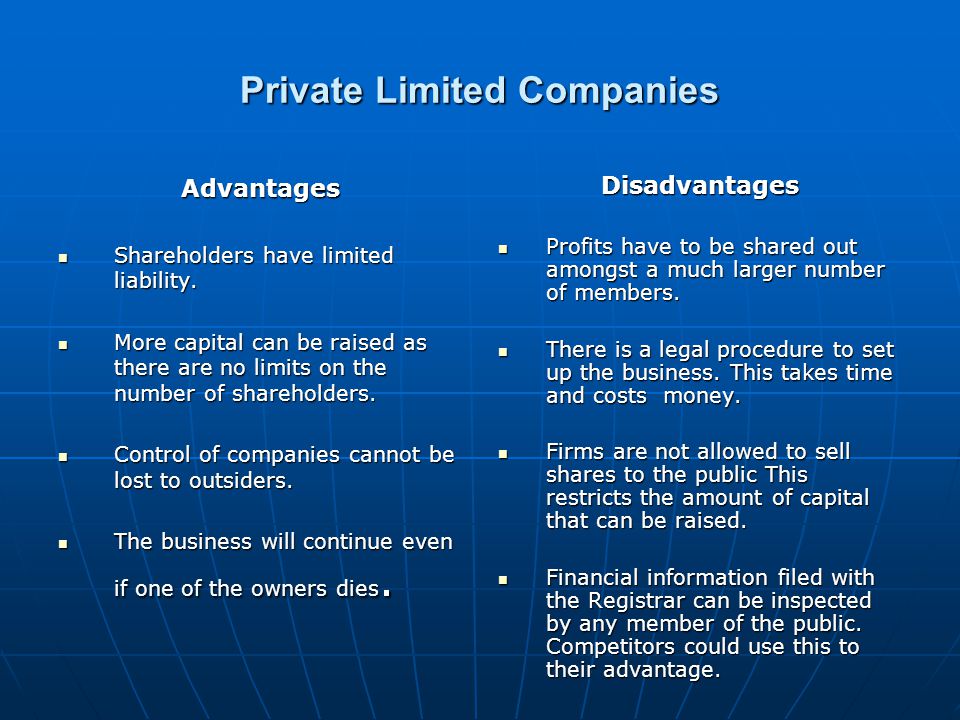

Limited Liability Company (Private Limited Liability Company)

Limited Liability Company (Private Limited Liability Company)

CONTENT

1. Private Limited Liability Company (Meaning)

2. Advantages, Disadvantages and Comparison between Public and Private companies

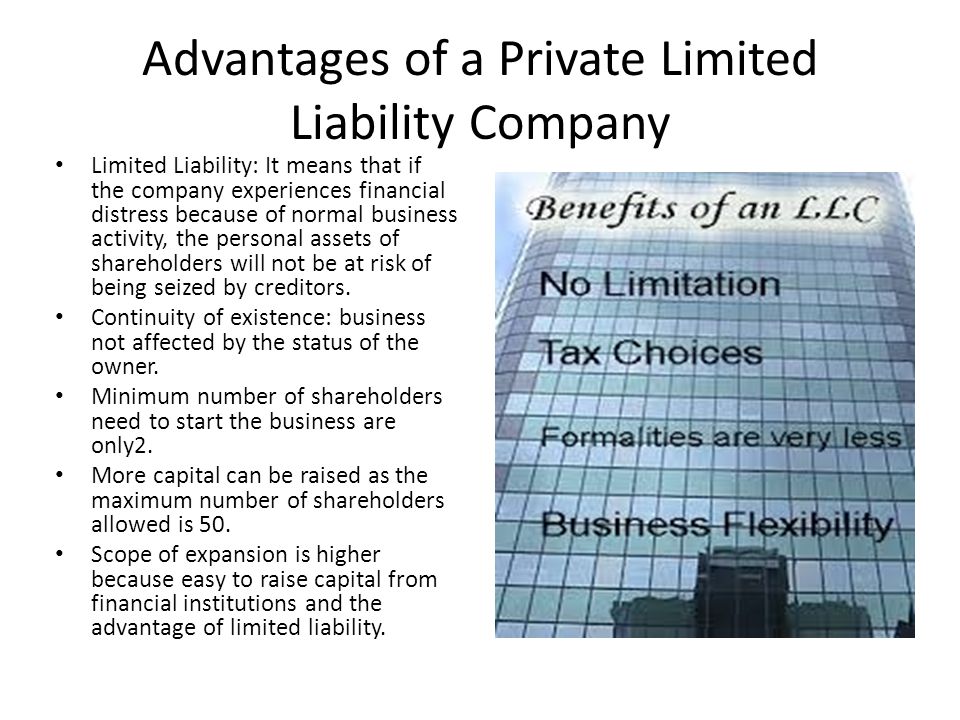

Meaning of Private Limited Liability Company:

A private limited liability company is a profitable making business with few shareholders and no open market for its shares. Examples of private limited liability company are Newswatch Communication Ltd., Ekene Dili Chukwu Transport service Ltd., JIMBAZ Construction Company Ltd. etc.

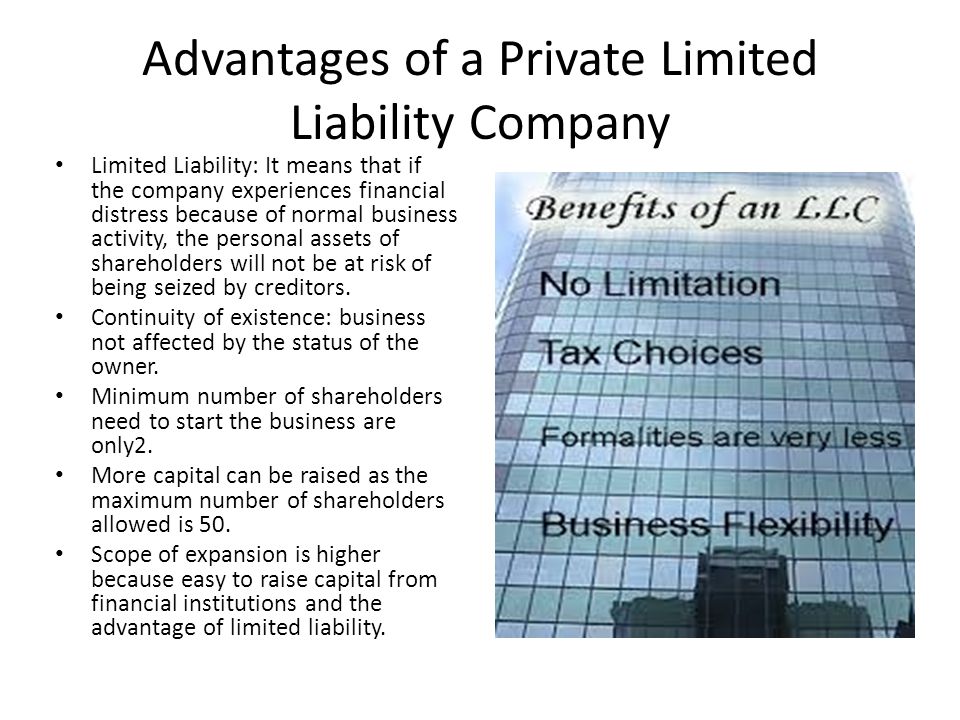

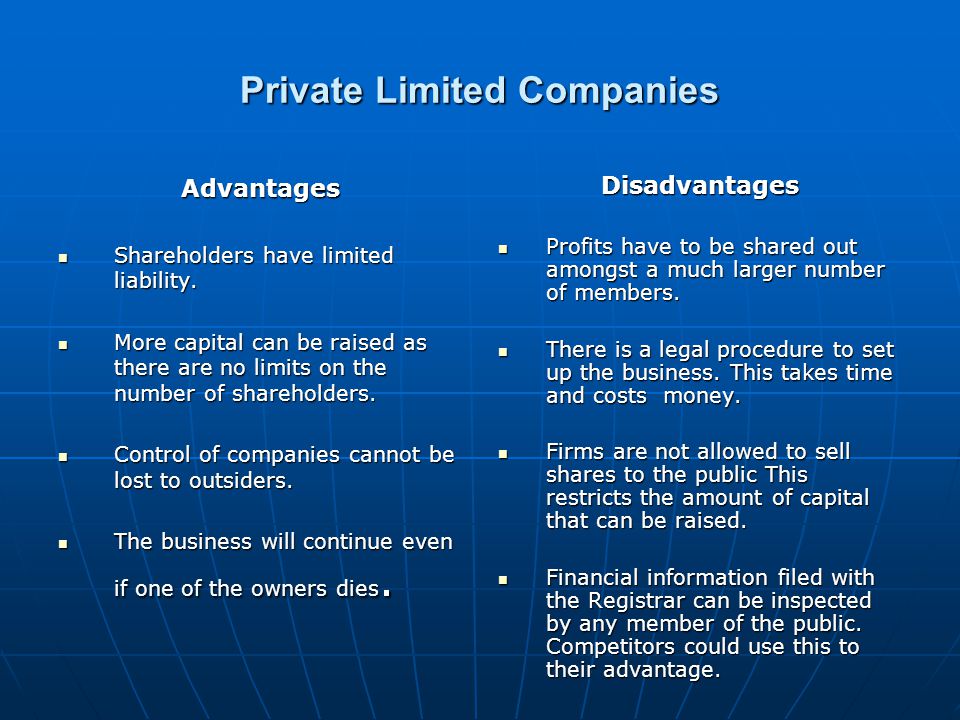

Advantages of Private Limited Liability Company

(i) They enjoy privacy.

(ii) Their annual report and accounts are not required by law to be published, except for

Taxation.

(iii) Management and control is less complex than in public limited company. Its

management structure is simple.

Disadvantages of Private Limited Liability Company

Disadvantages of Private Limited Liability Company

(i) Shares cannot be issued to the public.

(ii) Capacity to raise external finance to expand business is limited.

(iii) Transfer of shares to others is made difficult.

1. Comparison between the Private and Public Limited Liability Companies.

1. Comparison between the Private and Public Limited Liability Companies.

S/N PUBLIC LIMITED COMPANY -------------------------PRIVATE LIMITED COMPANY

1. Minimum number of members is seven and has no maximum------------ Minimum number of members is two while the maximum is fifty.

2. Shares are offered to the public. -----------------------Shares may not be offered to the public.

3. Shares are easily transferable.------------------ Shares are not transferable.

4. Account is publish to the public----------------------- Account is publish for the information of Registrar of companies.

https://www.slideshare.net/krishnakhata ... ed-company

EVALUATION

1. What is a limited liability company?

2. State 3 advantages of public limited liability company

READING ASSIGNMENT

Business studies for junior secondary schools, new edition book 1 by O. A. Lawal Chapter 5 pages 23-25

1. Define Private Limited Liability Company

2. State the comparison between the public and private companies.

3. Outline the 4 advantages and the 4 disadvantages of Private companies.

ASSIGNMENT

1. The maximum number of members in a private limited liability company (a) 50 (b) 100 (c) 10

2. Private liability company enjoys. (a ) enough capital (b) privacy (c) non-Payment of tax (d) transfer of shares to others.

3. The following are disadvantages of private limited liability company except (a) not listed in the stock exchange (b) cannot sell shares (c) management structure is simple.

4. The minimum number of owners needed to form a public limited company

Is (a) seven ( b)two (c) fifty (d) eight

5. Which of this can sell shares to the public (a) Sole proprietor (b) Private

Limited company (c) Public limited company

6. The maximum number of owners a public Limited liability company is (a) twenty (b) two (c) no maximum.

7. Public Limited Liability Company is owned by ------------------ (a) government (b) politicians (c) Shareholders

8. The major source of capital for Public Limited Liability Company is

(a) selling of shares (b) personal savings (c) partnership contribution

THEORY

1. State 3 advantages of private limited liability company

2. Enumerate 3 disadvantages of private limited liability company