WEEK 10

Posted: Fri Jun 19, 2015 8:42 pm

LESSON 17

MAIN TOPIC: INTRODUCTION TO BOOK-KEEPING

SPECIFIC TOPIC: Meaning and importance

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 54-55

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 47-48

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

define book-keeping

mention importance of book-keeping

CONTENTS:

Very few traders know the art of keeping proper record of their business transactions. that is, what they buy and sell and the amount of profit they make from it.

Book-keeping is the art of recording business transactions in a regular and systematic manner such that the record would be in a permanent form.

Transfer means the transfer of goods and services from one person to another.

IMPORTANCE OF BOOK-KEEPING

It provides the systematic recording of business transactions

It provides a means by which an enterprise can be conducted in an orderly manner

It provides a basis for recording and referring to at any point in time.

It shows at the end of a period whether a business has recorded any profit or loss or break even.

EVALUATION:

What is book-keeping?

Mention three importance of book-keeping.

HOME-WORK: mention three qualities of a book-keeper

SPECIFIC TOPIC: Qualities of a book-keeper

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 54-55

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 47-48

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

mention the job qualities of a book-keeper

mention the personal qualities of a book-keeper

CONTENTS:

PERSONAL QUALITIES

Must possess minimum of high school education to enhance reading and writing legibly

Must be honest

Must be reliable

Must have self confidence

JOB QUALITIES

Must be accurate- a mathematical ability is essential

Must be intelligent and alert to issues concerning his job

Must be tactful

Must possess accounting skills

EVALUATION:

Mention four job qualities of a book-keeper.

Mention three personal qualities of a book-keeper.

HOME-WORK: Briefly mention three book-keeping ethics.

SPECIFIC TOPIC: Book-keeping ethics

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 54-55

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 47-48

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

mention common book-keeping ethics

mention book-keeping ethics

CONTENTS:

COMMON BOOK-KEEPING PRACTICE

Issuing of receipts to a customer after sales.

Entering of sales transaction into sales book on a daily basis

Entering the amount of goods returned into the appropriate book.

BOOK-KEEPING ETHICS

Accurate keeping of records

Avoid cancelling

Keep all records safe and tidy

Make information available as at when needed.

EVALUATION:

mention three common book-keeping practice and four book- keeping ethics

HOME-WORK: what are daybooks?

LESSON 18

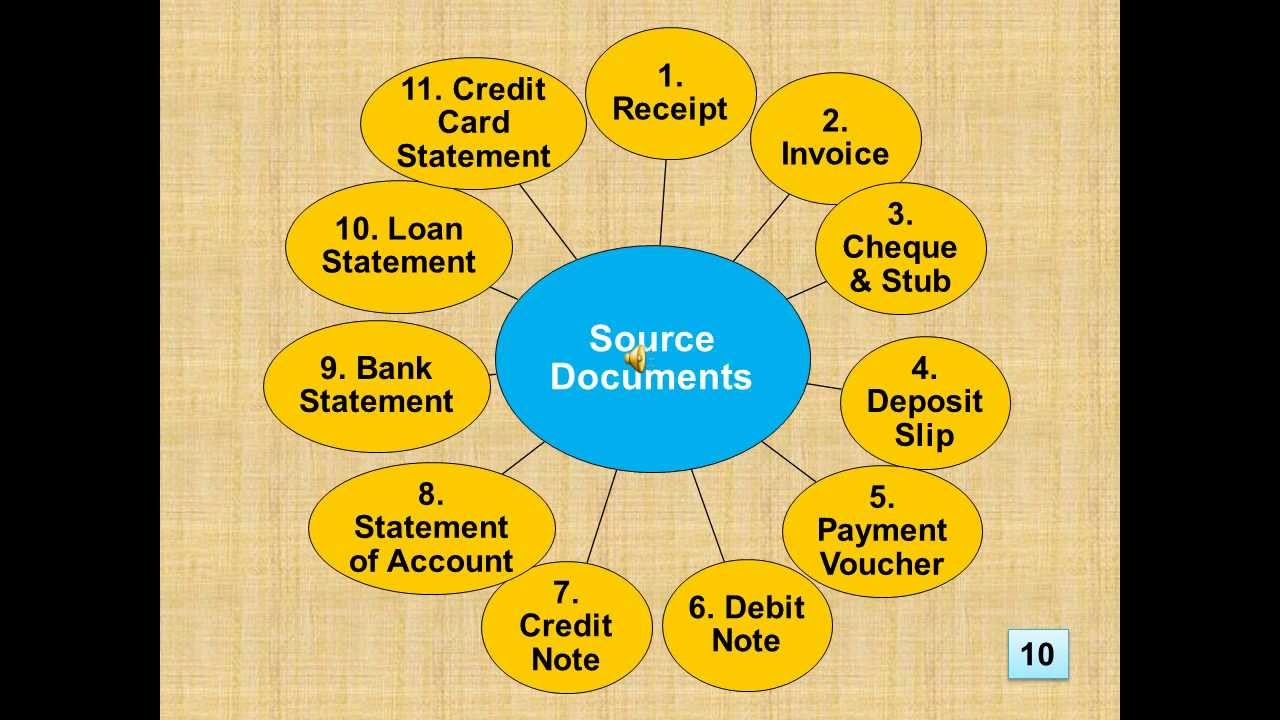

MAIN TOPIC: SOURCE DOCUMENTS

SPECIFIC TOPIC: Meaning and importance

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 56-58

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 49-52

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning of source documents

give examples of source documents

mention some of the uses of source documents

CONTENTS:

In order to keep records of business transaction documents are issued to show that certain transactions has taken place. E.g. when you pay school fees, receipt is given.

The book-keeper uses these documents {such as receipt} to prepare books of accounts of the business.

These documents are called source documents because they are the first source of information from which accounting books are prepared.

Source documents are the documents in which original business transactions are first recorded before been transferred into subsidiary books of accounts.

Examples of source documents include: invoice, voucher, cheque, receipt, credit note, debit note etc.

EVALUATION:

What are source document?

Mention three source documents that you know

Mention the purpose/ uses of source documents.

HOME-WORK: explain invoice, credit note and debit note.

SPECIFIC TOPIC: invoice, credit note and debit note.

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 56-58

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 49-52

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning and uses of an invoice

state the meaning and uses of credit note

state the meaning and uses of debit note

CONTENTS:

INVOICE

This is the document issued by the seller to the buyer showing the description of the goods purchased, the terms of agreement, quantity and price. It may also contain any deposit paid and the balance outstanding.

CREDIT NOTE

This is issued by a supplier when a buyer returns goods to the supplier. It may also be issued by a supplier to a buyer when the buyer has overcharged the buyer. It shows that the amount of money to be paid by the buyer has reduced.

DEBIT NOTE

This is a document that is issued by the seller to the buyer to show that the buyer has been undercharged.

EVALUATION:

Explain the following in details invoice, credit note and debit note.

HOME-WORK: write short notes on receipt, cheque and voucher

SPECIFIC TOPIC: Receipt, Cheque and Voucher

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 56-58

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 49-52

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning and uses of a receipt

state the meaning and uses of a cheque

state the meaning and uses of a voucher

CONTENTS:

RECEIPT

This is a document which the seller issues to the buyer in order to acknowledge receipt of payment for the goods sold.

CHEQUE

A cheque is a written order to a bank to pay a certain some of money to another person or to the owner of the cheque.

VOUCHER

Any document which is used to support an entry in the books of account is called a voucher.

EVALUATION:

mention three common book-keeping practice and four book- keeping ethics

HOME-WORK: what are daybooks?

LESSON 19

MAIN TOPIC: DOUBLE ENTRY BOOK-KEEPING

SPECIFIC TOPIC: Meaning and format

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 61-67

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 58-65

Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Pages 67-74

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning of double entry

state the principle of double entry

draw the format of double entry account

CONTENTS:

Double entry is a system of book-keeping in which transactions are first recorded in both the debit and credit sides of the ledger at the same time.

The double entry principle states that - For every debit entry there must be a corresponding credit entry and vice versa.

Double entry records are kept in a book called a ledger and each page in a ledger is called an account.

EVALUATION:

What is book-keeping?

state double entry principle

Draw the format of a double entry account.

HOME-WORK: what are asset, liability and capital?

SPECIFIC TOPIC: Golden rule of double entry

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 61-67

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 58-65

Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Pages 67-74

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning of asset, liability and capital

state and apply the golden rule in book-keeping

CONTENTS:

An Asset is anything of value that is owned by a business

A Liability is an amount owed by a business to others.

Capital is the total investment in a business.

GOLDEN RULE:

Debit- The account that receives

Credit- The account that gives

Capital account is always on the credit side

EVALUATION:

What are assets, liability and capital

Give examples of asset and liability

HOME-WORK: State the double entry principle

SPECIFIC TOPIC: Exercises on double entry book-keeping

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 61-67

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 58-65

Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Pages 67-74

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

solve questions relating to double entry book-keeping correctly

CONTENTS:

Question 3 Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Page74

Question 1 and 2 WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 64

EVALUATION:

Question 5 Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Page74

HOME-WORK: what are ledgers?

LESSON 20

MAIN TOPIC: LEDGER

SPECIFIC TOPIC: Meaning and classification

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 65-67

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 61-65

Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Pages 75-84

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning of ledger

state the classification of ledger

draw the format of ledger

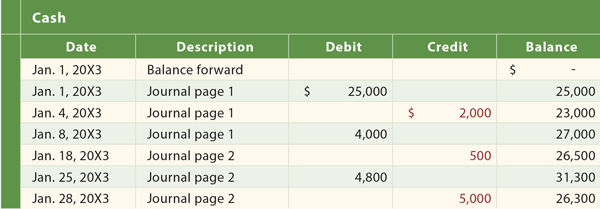

CONTENTS:

A general ledger account is an account or record used to sort and store balance sheet and income statement transactions. Examples of general ledger accounts include the asset accounts such as Cash, Accounts Receivable, Inventory, Investments, Land, and Equipment. Examples of the general ledger liability accounts include Notes Payable, Accounts Payable, Accrued Expenses Payable, and Customer Deposits. Examples of income statement accounts found in the general ledger include Sales, Service Fee Revenues, Salaries Expense, Rent Expense, Advertising Expense, Interest Expense, and Loss on Disposal of Assets.

Some general ledger accounts are summary records which are referred to as control accounts. The detail that supports each of the control accounts will be found outside of the general ledger in what is known as a subsidiary ledger. For example, Accounts Receivable could be a control account in the general ledger, and there will be a subsidiary ledger which contains each customer's credit activity. The general ledger accounts Inventory, Equipment, and Accounts Payable could also be control accounts and for each there will be a subsidiary ledger containing the supporting detail.

The ledger is a principal book of account in which all the transactions that take place in a business organisation are recorded.

CLASSIFICATION OF LEDGER

Ledger accounts can be divided into

Personal account: These are the accounts for debtors and creditors.

Impersonal account: This can further be divided into real and nominal account.

Nominal accounts: These are accounts of income and expenditure such as wages, rent, electricity etc. They cannot be seen or touched.

Real account: These are account relating to property or material objects. E.g land, car, plant etc.

EVALUATION:

What is ledger?

mention two classification of ledger with examples

Draw the format of a ledger.

HOME-WORK: what is typewriting?

MAIN TOPIC: INTRODUCTION TO BOOK-KEEPING

SPECIFIC TOPIC: Meaning and importance

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 54-55

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 47-48

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

define book-keeping

mention importance of book-keeping

CONTENTS:

Very few traders know the art of keeping proper record of their business transactions. that is, what they buy and sell and the amount of profit they make from it.

Book-keeping is the art of recording business transactions in a regular and systematic manner such that the record would be in a permanent form.

Transfer means the transfer of goods and services from one person to another.

IMPORTANCE OF BOOK-KEEPING

It provides the systematic recording of business transactions

It provides a means by which an enterprise can be conducted in an orderly manner

It provides a basis for recording and referring to at any point in time.

It shows at the end of a period whether a business has recorded any profit or loss or break even.

EVALUATION:

What is book-keeping?

Mention three importance of book-keeping.

HOME-WORK: mention three qualities of a book-keeper

SPECIFIC TOPIC: Qualities of a book-keeper

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 54-55

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 47-48

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

mention the job qualities of a book-keeper

mention the personal qualities of a book-keeper

CONTENTS:

PERSONAL QUALITIES

Must possess minimum of high school education to enhance reading and writing legibly

Must be honest

Must be reliable

Must have self confidence

JOB QUALITIES

Must be accurate- a mathematical ability is essential

Must be intelligent and alert to issues concerning his job

Must be tactful

Must possess accounting skills

EVALUATION:

Mention four job qualities of a book-keeper.

Mention three personal qualities of a book-keeper.

HOME-WORK: Briefly mention three book-keeping ethics.

SPECIFIC TOPIC: Book-keeping ethics

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 54-55

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 47-48

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

mention common book-keeping ethics

mention book-keeping ethics

CONTENTS:

COMMON BOOK-KEEPING PRACTICE

Issuing of receipts to a customer after sales.

Entering of sales transaction into sales book on a daily basis

Entering the amount of goods returned into the appropriate book.

BOOK-KEEPING ETHICS

Accurate keeping of records

Avoid cancelling

Keep all records safe and tidy

Make information available as at when needed.

EVALUATION:

mention three common book-keeping practice and four book- keeping ethics

HOME-WORK: what are daybooks?

LESSON 18

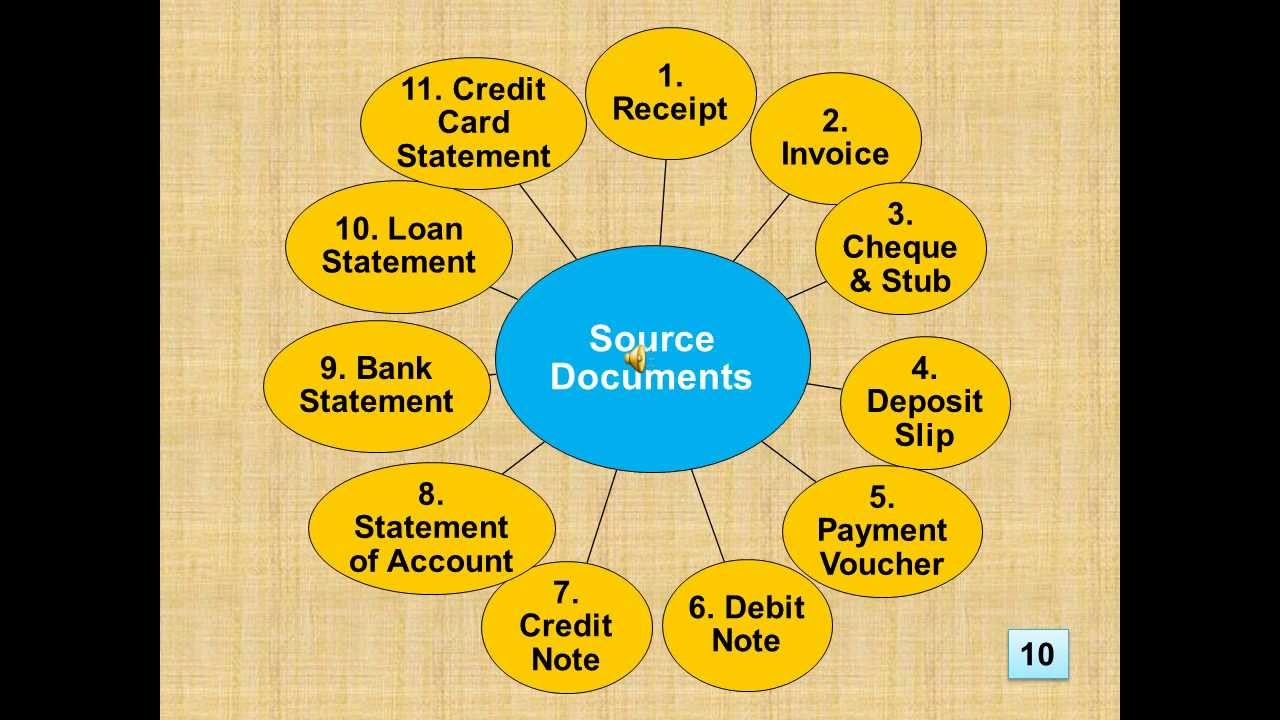

MAIN TOPIC: SOURCE DOCUMENTS

SPECIFIC TOPIC: Meaning and importance

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 56-58

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 49-52

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning of source documents

give examples of source documents

mention some of the uses of source documents

CONTENTS:

In order to keep records of business transaction documents are issued to show that certain transactions has taken place. E.g. when you pay school fees, receipt is given.

The book-keeper uses these documents {such as receipt} to prepare books of accounts of the business.

These documents are called source documents because they are the first source of information from which accounting books are prepared.

Source documents are the documents in which original business transactions are first recorded before been transferred into subsidiary books of accounts.

Examples of source documents include: invoice, voucher, cheque, receipt, credit note, debit note etc.

EVALUATION:

What are source document?

Mention three source documents that you know

Mention the purpose/ uses of source documents.

HOME-WORK: explain invoice, credit note and debit note.

SPECIFIC TOPIC: invoice, credit note and debit note.

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 56-58

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 49-52

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning and uses of an invoice

state the meaning and uses of credit note

state the meaning and uses of debit note

CONTENTS:

INVOICE

This is the document issued by the seller to the buyer showing the description of the goods purchased, the terms of agreement, quantity and price. It may also contain any deposit paid and the balance outstanding.

CREDIT NOTE

This is issued by a supplier when a buyer returns goods to the supplier. It may also be issued by a supplier to a buyer when the buyer has overcharged the buyer. It shows that the amount of money to be paid by the buyer has reduced.

DEBIT NOTE

This is a document that is issued by the seller to the buyer to show that the buyer has been undercharged.

EVALUATION:

Explain the following in details invoice, credit note and debit note.

HOME-WORK: write short notes on receipt, cheque and voucher

SPECIFIC TOPIC: Receipt, Cheque and Voucher

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 56-58

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 49-52

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning and uses of a receipt

state the meaning and uses of a cheque

state the meaning and uses of a voucher

CONTENTS:

RECEIPT

This is a document which the seller issues to the buyer in order to acknowledge receipt of payment for the goods sold.

CHEQUE

A cheque is a written order to a bank to pay a certain some of money to another person or to the owner of the cheque.

VOUCHER

Any document which is used to support an entry in the books of account is called a voucher.

EVALUATION:

mention three common book-keeping practice and four book- keeping ethics

HOME-WORK: what are daybooks?

LESSON 19

MAIN TOPIC: DOUBLE ENTRY BOOK-KEEPING

SPECIFIC TOPIC: Meaning and format

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 61-67

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 58-65

Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Pages 67-74

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning of double entry

state the principle of double entry

draw the format of double entry account

CONTENTS:

Double entry is a system of book-keeping in which transactions are first recorded in both the debit and credit sides of the ledger at the same time.

The double entry principle states that - For every debit entry there must be a corresponding credit entry and vice versa.

Double entry records are kept in a book called a ledger and each page in a ledger is called an account.

EVALUATION:

What is book-keeping?

state double entry principle

Draw the format of a double entry account.

HOME-WORK: what are asset, liability and capital?

SPECIFIC TOPIC: Golden rule of double entry

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 61-67

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 58-65

Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Pages 67-74

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning of asset, liability and capital

state and apply the golden rule in book-keeping

CONTENTS:

An Asset is anything of value that is owned by a business

A Liability is an amount owed by a business to others.

Capital is the total investment in a business.

GOLDEN RULE:

Debit- The account that receives

Credit- The account that gives

Capital account is always on the credit side

EVALUATION:

What are assets, liability and capital

Give examples of asset and liability

HOME-WORK: State the double entry principle

SPECIFIC TOPIC: Exercises on double entry book-keeping

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 61-67

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 58-65

Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Pages 67-74

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

solve questions relating to double entry book-keeping correctly

CONTENTS:

Question 3 Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Page74

Question 1 and 2 WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 64

EVALUATION:

Question 5 Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Page74

HOME-WORK: what are ledgers?

LESSON 20

MAIN TOPIC: LEDGER

SPECIFIC TOPIC: Meaning and classification

REFERENCE BOOKS:

Macmillan JSS1 Business Studies by Awoyokun A.A et al .Pages 65-67

WABP JSS Business Studies 1by Egbe T. Ehiametalor. Pages 61-65

Spectrum Business Studies by Eno L.Inanga and Ebun C.Ojo Pages 75-84

PERFORMANCE OBJECTIVES: At the end of the lesson, students should be able to:

state the meaning of ledger

state the classification of ledger

draw the format of ledger

CONTENTS:

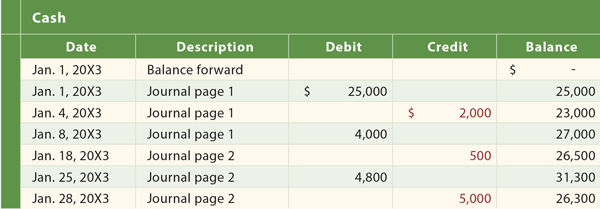

A general ledger account is an account or record used to sort and store balance sheet and income statement transactions. Examples of general ledger accounts include the asset accounts such as Cash, Accounts Receivable, Inventory, Investments, Land, and Equipment. Examples of the general ledger liability accounts include Notes Payable, Accounts Payable, Accrued Expenses Payable, and Customer Deposits. Examples of income statement accounts found in the general ledger include Sales, Service Fee Revenues, Salaries Expense, Rent Expense, Advertising Expense, Interest Expense, and Loss on Disposal of Assets.

Some general ledger accounts are summary records which are referred to as control accounts. The detail that supports each of the control accounts will be found outside of the general ledger in what is known as a subsidiary ledger. For example, Accounts Receivable could be a control account in the general ledger, and there will be a subsidiary ledger which contains each customer's credit activity. The general ledger accounts Inventory, Equipment, and Accounts Payable could also be control accounts and for each there will be a subsidiary ledger containing the supporting detail.

The ledger is a principal book of account in which all the transactions that take place in a business organisation are recorded.

CLASSIFICATION OF LEDGER

Ledger accounts can be divided into

Personal account: These are the accounts for debtors and creditors.

Impersonal account: This can further be divided into real and nominal account.

Nominal accounts: These are accounts of income and expenditure such as wages, rent, electricity etc. They cannot be seen or touched.

Real account: These are account relating to property or material objects. E.g land, car, plant etc.

EVALUATION:

What is ledger?

mention two classification of ledger with examples

Draw the format of a ledger.

HOME-WORK: what is typewriting?